Shipping from China is not just about moving cargo—it’s a process that depends heavily on accurate, compliant, and complete documentation. As the Co-founder of DFH Logistics, with over 12 years of hands-on experience in international freight forwarding, I’ve seen countless importers face costly delays or penalties simply because of missing or incorrect paperwork.

In this detailed guide, I’ll walk you through every essential shipping document you need when exporting goods from China, explain what each document is for, when it’s required, how to prepare it properly, and common mistakes to avoid. By understanding this documentation system, you’ll make your shipments faster, smoother, and fully compliant with customs regulations.

To ship goods from China successfully, you must prepare a full set of documents including the Commercial Invoice, Packing List, Bill of Lading or Air Waybill, Export Declaration, Certificate of Origin, Insurance Certificate, Import License, and other supporting documents such as inspection or fumigation certificates, depending on product type and destination.

What Are the Essential Shipping Documents from China?

The most critical documents required for any international shipment from China include:

- Commercial Invoice (CI)

- Packing List (PL)

- Bill of Lading (B/L) or Air Waybill (AWB)

- Export Declaration (Shipping Bill)

- Certificate of Origin (CO)

- Insurance Certificate (if insured)

- Import License or Permit (for restricted goods)

Each document serves a specific legal, logistical, or customs-related purpose. Together, they ensure your goods are properly declared, transported, and cleared without delays or financial risk.

At DFH Logistics, we provide end-to-end support—preparing, verifying, and submitting every document on behalf of our clients to avoid errors that often cause customs clearance issues.

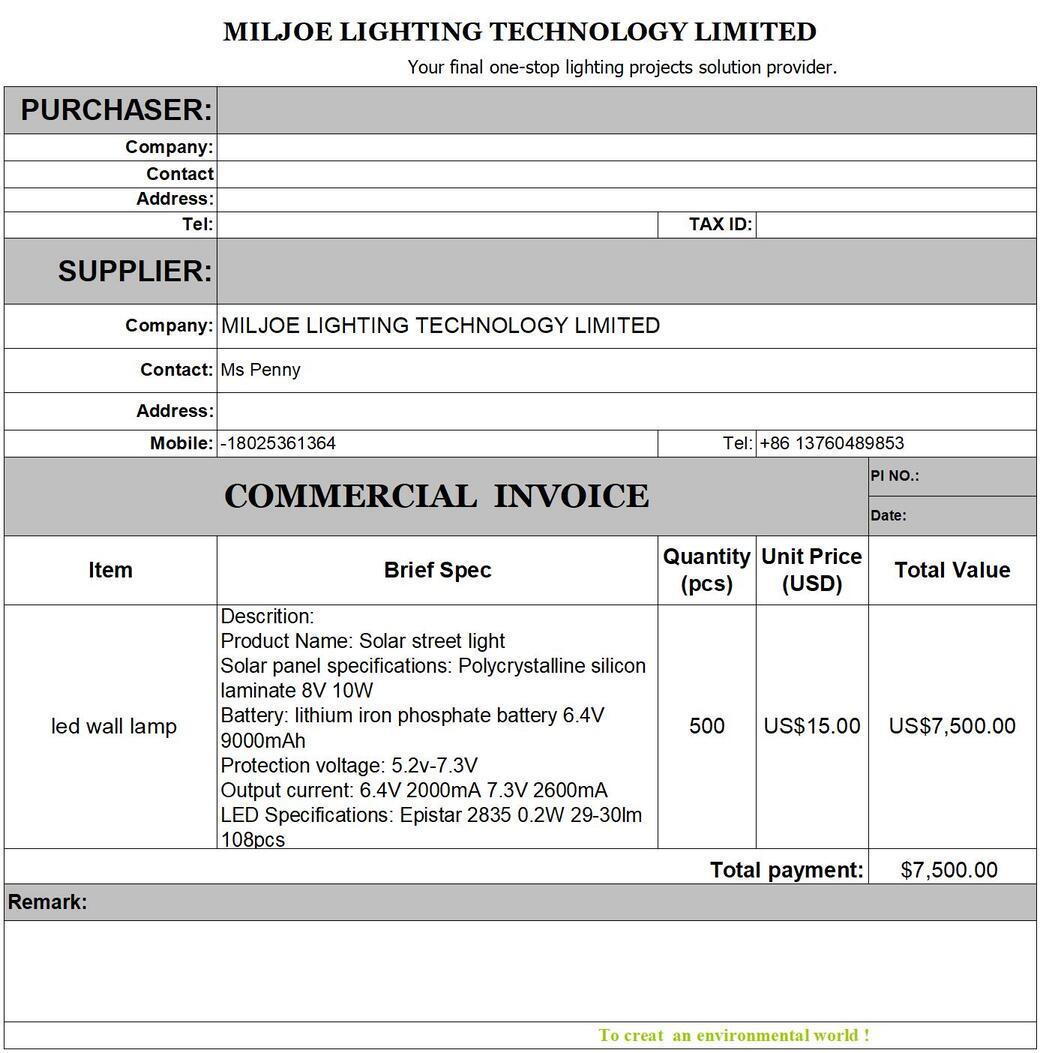

What Is a Commercial Invoice and Why Is It Crucial?

The Commercial Invoice is the backbone of any international shipment. It is issued by the seller (exporter) to the buyer (importer) and represents the official record of sale. Customs officers use it to verify declared values, product descriptions, and apply the correct import duties and taxes.

Key elements of a Commercial Invoice:

- Seller and buyer details

- Invoice number and date

- Description of goods with HS codes

- Unit price and total value

- Trade terms (Incoterms like FOB, CIF, DDP)

- Origin country and destination

- Signature and company stamp

Common Mistakes to Avoid:

- Using vague product descriptions like “goods” or “samples” — customs require clear item names.

- Incorrect HS codes — leads to wrong duty calculation or inspection.

- Mismatched totals between the invoice, packing list, and B/L.

At DFH, we cross-verify all values and codes to ensure your invoice passes customs checks smoothly.

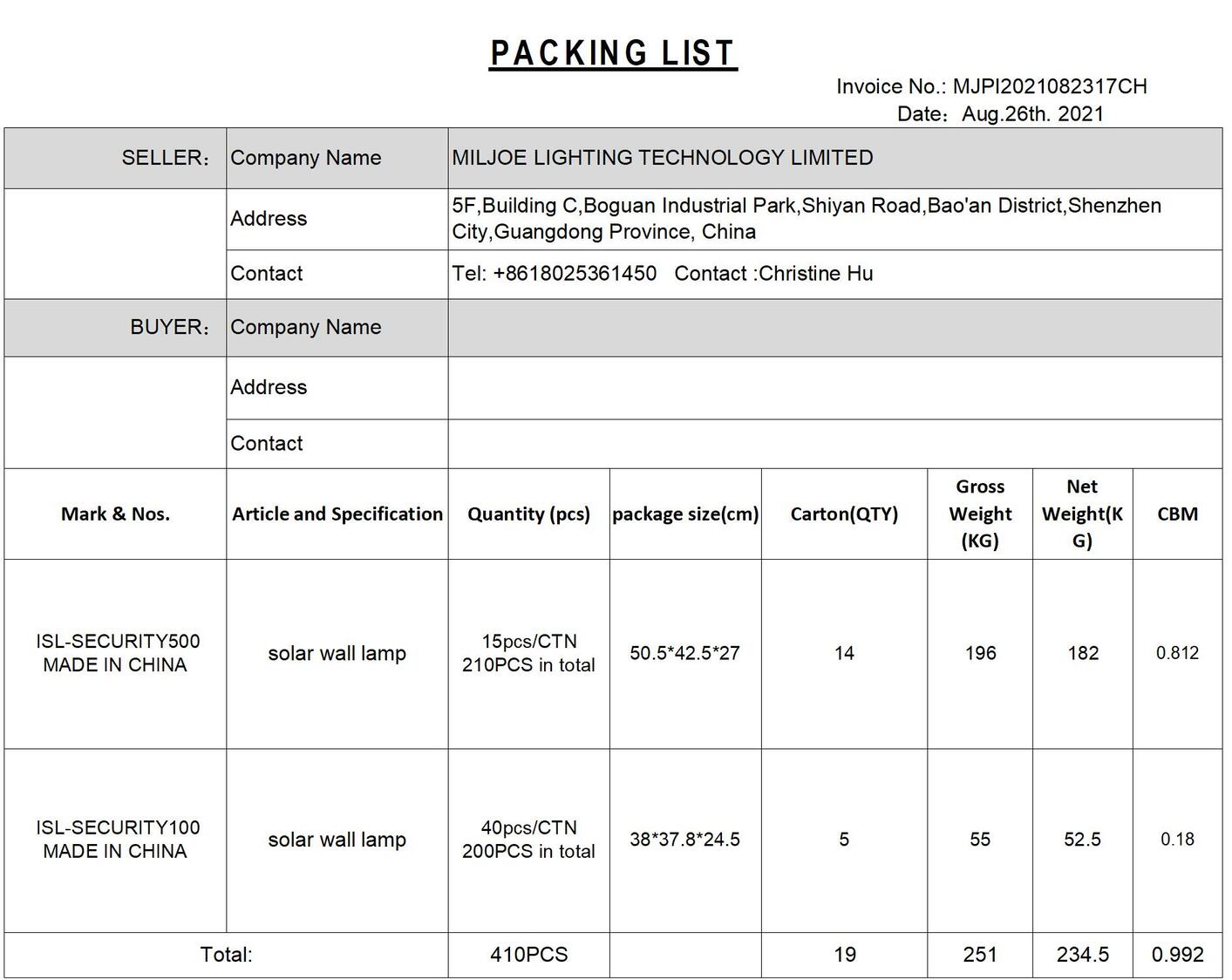

What Is the Packing List and What Details Should It Include?

ALT: packing list details

The Packing List complements the Commercial Invoice. It provides detailed information about how the goods are packed, including weight, volume, dimensions, and package count.

Typical contents:

- Exporter, consignee, and shipment reference

- Total number of cartons or pallets

- Dimensions (L×W×H) and weight per package

- Gross and net weight

- Type of packaging (carton, crate, drum, etc.)

- Marks and numbers on the packages

Why it matters:

Customs officers use the packing list to physically check the cargo during inspections. A mismatch between documents and the actual cargo can cause customs holds or fines.

We always prepare both English and Chinese versions when needed to meet both export and import requirements.

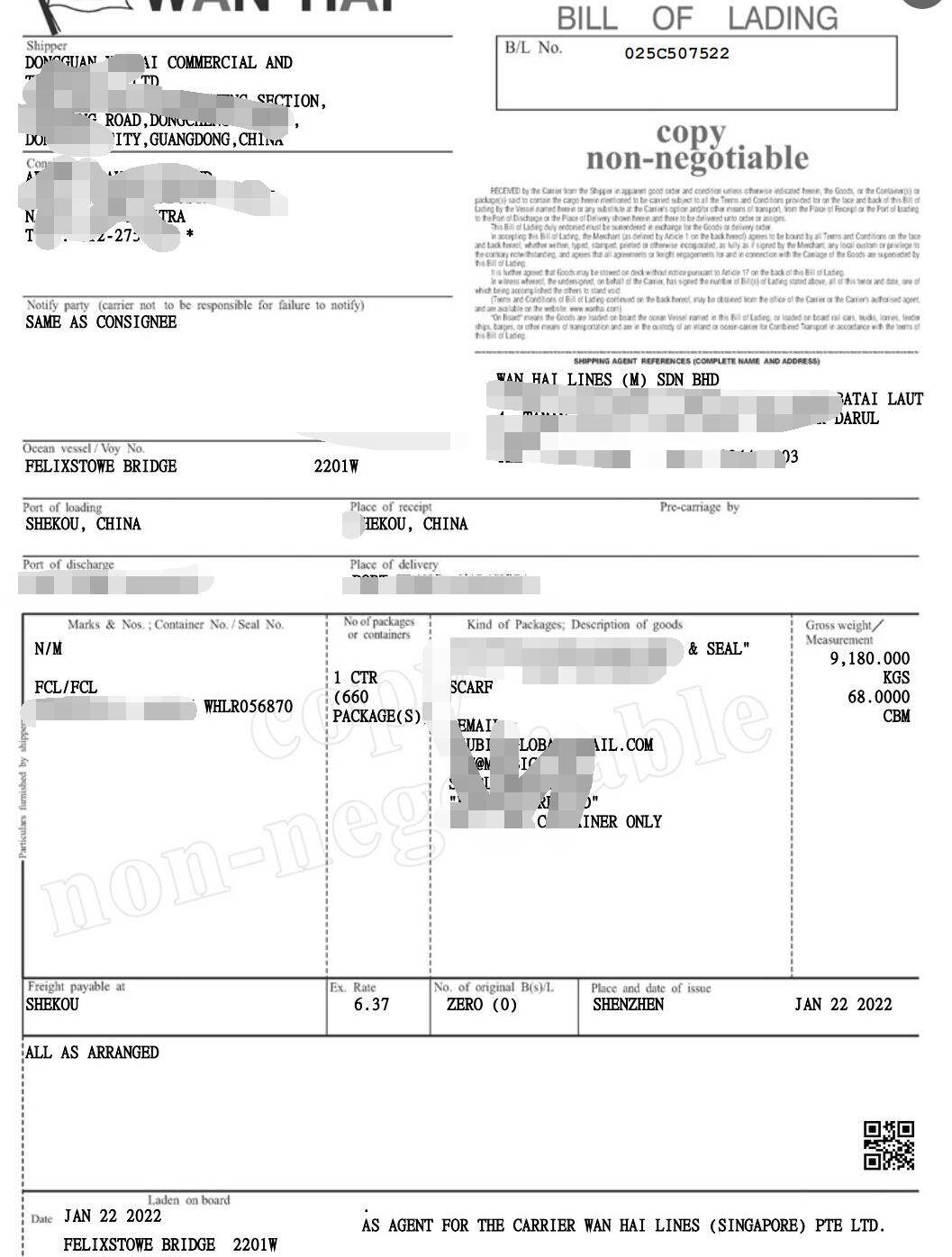

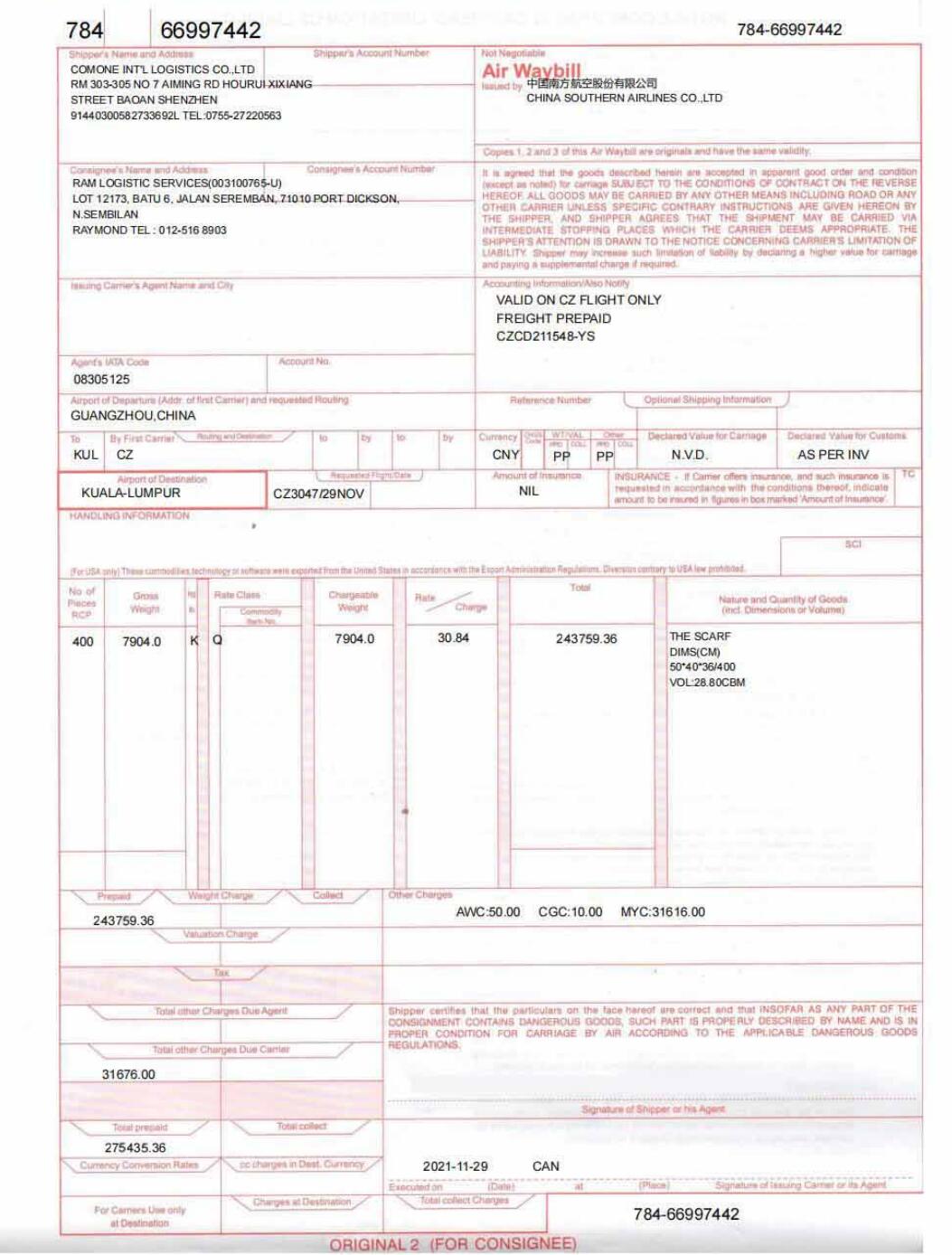

What Is a Bill of Lading or Air Waybill?

The Bill of Lading (B/L) or Air Waybill (AWB) serves as the transport contract and proof that goods were received by the carrier. It’s one of the most powerful documents in shipping—it can even represent ownership of the goods.

For Sea Freight (Bill of Lading):

- Issued by the shipping line or forwarder.

- Acts as the contract of carriage, receipt of goods, and title document.

- Contains the shipper, consignee, vessel name, container number, port of loading and discharge, and Incoterms.

For Air Freight (Air Waybill):

ALT: bill of lading document

- Issued by airlines or air freight agents.

- Non-negotiable, serving as proof of carriage but not title.

- Includes air waybill number, origin/destination airports, and declared value.

Tip:

Ensure the consignee name and address exactly match your import documents. If your forwarder issues a “House B/L,” ensure it’s backed by a “Master B/L” for carrier recognition.

At DFH Logistics, we issue both House and Master Bills of Lading, ensuring that importers have complete control and traceability over their cargo movement.

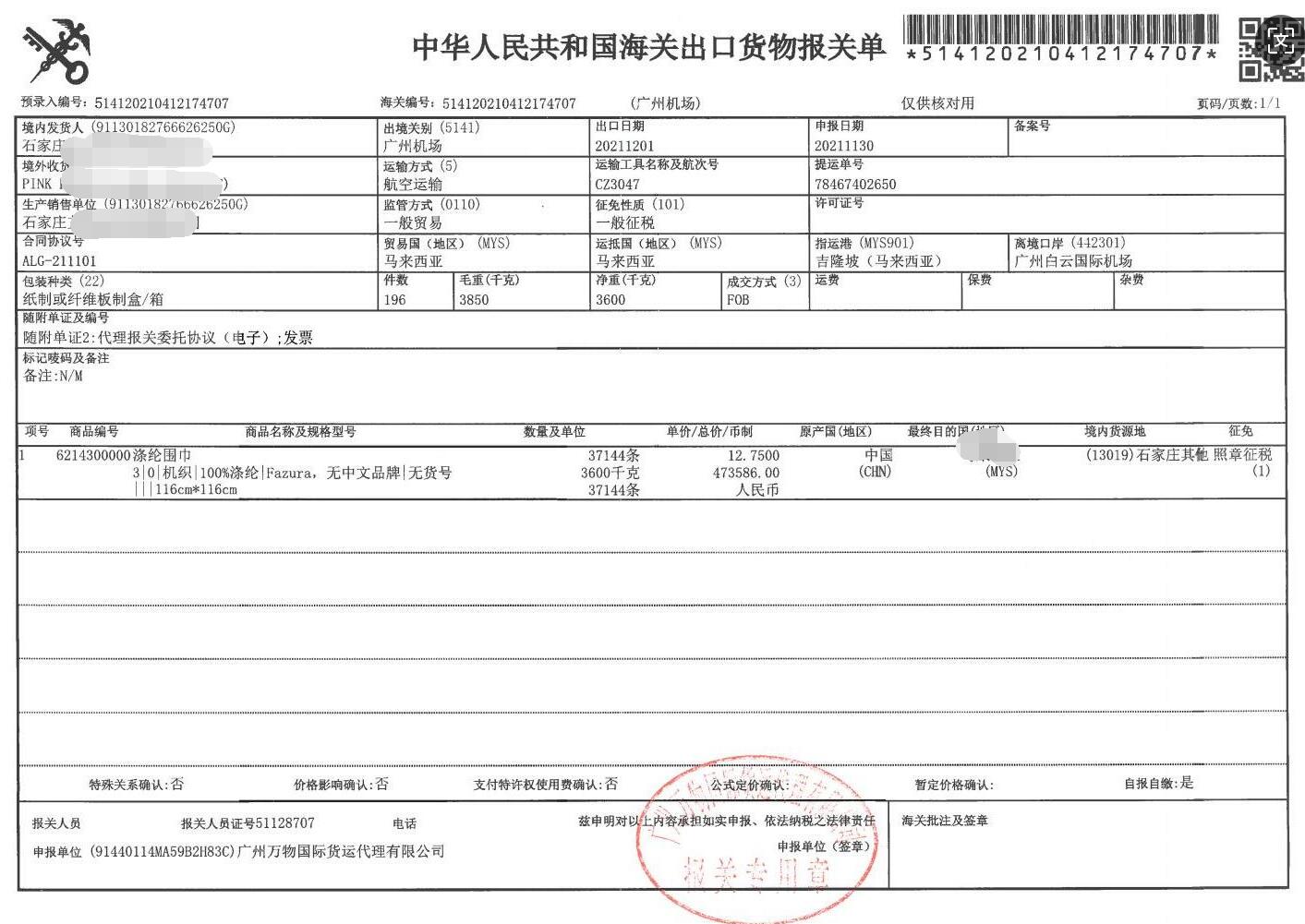

Why Is the Export Declaration Required?

ALT: export declaration china

The Export Declaration Form—also known as Customs Export Declaration—is submitted to Chinese Customs before any goods can legally leave China.

It confirms the shipment’s legality, export value, product classification (HS code), and destination.

Key contents:

- Exporter’s business license and tax number

- Exporter’s Customs Registration Code

- HS codes and description

- Quantity, unit, and total value

- Port of export

- Destination country

Who submits it:

Usually, your supplier or freight forwarder. If your supplier has no export rights, DFH Logistics can declare the shipment under our export license—this is a common solution for small factories and trading companies.

What Is a Certificate of Origin and When Is It Needed?

The Certificate of Origin (CO) certifies where the goods were manufactured. It helps the destination customs authority determine the correct duty rate—some trade agreements allow reduced or zero import tariffs for certain origins.

Main types used in China:

- Form A – for countries under the Generalized System of Preferences (GSP).

- Form E – for ASEAN countries under the China–ASEAN Free Trade Agreement.

- Form F – for Chile, Peru, etc.

- Non-preferential CO – for countries without trade agreements.

How to obtain it:

Your supplier or forwarder applies to the China Council for the Promotion of International Trade (CCPIT) or local customs.

At DFH, we help clients verify eligibility and apply on their behalf.

What Is a Proforma Invoice and How Is It Used?

A Proforma Invoice is a preliminary document provided before shipment. It’s commonly used during quotation, order confirmation, or payment stages.

While not legally binding, it serves as a commercial reference between buyer and seller.

Why it’s important:

- Used for bank transactions or letter of credit applications.

- Helps buyers estimate total cost before shipping.

- Forms the basis for the final Commercial Invoice once goods are ready.

If you are applying for an import license or arranging insurance, your customs broker may request a copy of this document.

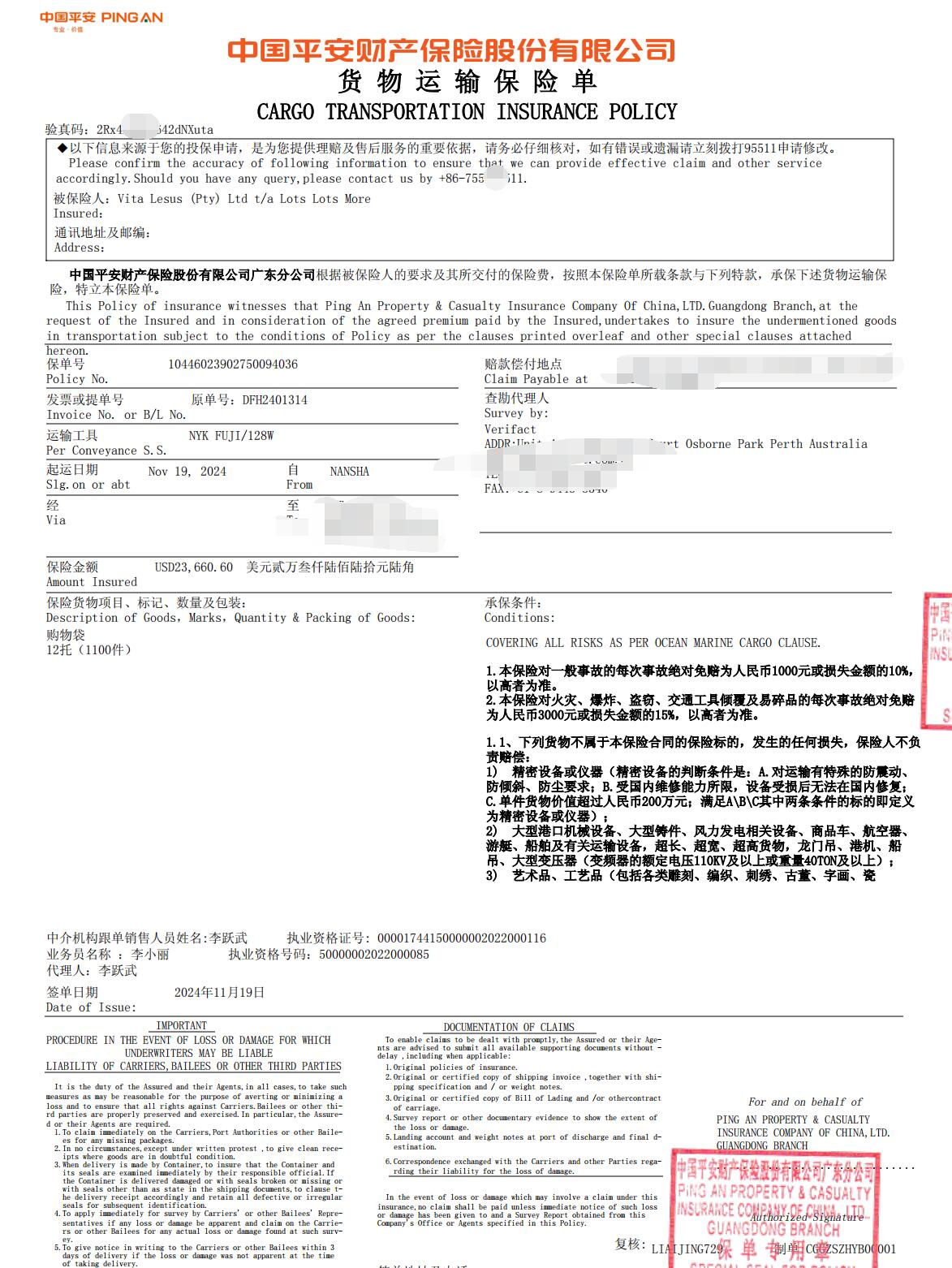

Why Do You Need an Insurance Certificate?

ALT: cargo insurance certificate

The Insurance Certificate is proof that your goods are covered against loss or damage during transportation. It’s usually required for CIF or CIP Incoterms, but many DDP importers also choose coverage for peace of mind.

Key points:

- Issued by insurance companies or the forwarder’s insurance partner.

- States the policy number, insured amount, coverage type (All Risks or FPA), and beneficiary.

- Usually covers invoice value + 10% for incidental expenses.

DFH Logistics helps clients purchase discounted cargo insurance policies covering warehouse-to-door, ensuring full protection even for multimodal shipments.

What Is an Import License or Permit?

Not all products can be freely imported. Many destination countries require import permits or licenses before customs clearance, especially for regulated goods such as:

- Electronics with wireless modules (Bluetooth, Wi-Fi)

- Cosmetics, food, and supplements

- Medical or health-related equipment

- Batteries, chemicals, and hazardous goods

Importer’s Responsibility:

Always check your local customs authority or freight forwarder before shipping. DFH assists clients by identifying if their HS codes fall under restricted categories and guides them in obtaining permits in advance to avoid shipment holds.

What Are Additional or Conditional Documents You Might Need?

Beyond the standard paperwork, some products or countries require specialized supporting documents:

| Document Type | Purpose | Typical Products |

|---|---|---|

| Inspection Certificate | Verifies product quality before export | Machinery, electronics |

| Fumigation Certificate | Confirms wooden packaging was treated | Furniture, pallets |

| MSDS (Material Safety Data Sheet) | Declares chemical composition and hazards | Liquids, chemicals, batteries |

| Phytosanitary Certificate | Certifies plant products are pest-free | Agricultural goods |

| Test Reports / CE or FCC Certificates | Prove compliance with standards | Electronics, toys |

| Import Customs Power of Attorney (POA) | Authorizes customs broker to clear goods | USA imports |

At DFH Logistics, we assess your product type before shipment and prepare all additional certificates required for your specific destination.

How Does Each Document Connect to Customs Clearance?

Every customs office—both in China and in the destination country—cross-checks your documentation set. Here’s how it works in practice:

Export side (China):

Chinese customs verifies the Export Declaration, Commercial Invoice, and Packing List to ensure product legality and export compliance.Transportation stage:

The carrier issues a Bill of Lading or Air Waybill based on verified documents, ensuring traceability and shipment ownership.Import side (destination):

Customs reviews the Commercial Invoice, CO, and Import License to determine tariff classification and release the cargo.

If insurance and inspection certificates are included, clearance becomes smoother, reducing inspection probability.

A single mismatch—such as a different HS code or incorrect weight—can result in long delays or penalties. That’s why DFH triple-checks every document before customs submission.

How a Freight Forwarder Helps You Handle All Documentation

A Reliable Freight Forwarder does more than move goods—they manage documentation and compliance for you.

At DFH Logistics, we specialize in handling every step of the paperwork to prevent customs problems, especially for clients without export experience.

Our support includes:

- Preparing and verifying all export documents

- Declaring shipments for suppliers without export licenses

- Applying for Certificates of Origin, fumigation, or inspection

- Arranging cargo insurance coverage

- Coordinating B/L or AWB issuance

- Handling import clearance, duties, and tax payments under DDP

With a forwarder managing documentation, you save time, avoid legal risks, and ensure faster customs clearance at both ends.

You Can read more about: Top 10 Freight Forwarders in China for USA Importers

Common Documentation Mistakes Importers Should Avoid

From experience, here are the most frequent document-related errors that cause shipment delays:

- Inconsistent values between Commercial Invoice and Packing List.

- Incorrect consignee or address on the Bill of Lading.

- Wrong HS code, resulting in improper duty assessment.

- Unstamped or unsigned documents — customs require authentication.

- Late submission of import permits or certificates.

- Missing export declaration from suppliers without export rights.

Practical tip:

Before shipment, request your forwarder to provide a document checklist and final review summary. DFH uses a multi-step verification system before loading to ensure every shipment is “customs-ready.”

Conclusion: Prepare Documents Right, Ship Without Delays

In global logistics, documentation is the key to speed and compliance. Missing or incorrect paperwork can stop your cargo at any port, no matter how fast the shipping channel is.

As the Co-founder of DFH Logistics, I’ve learned that importers who manage documents properly always enjoy lower costs, faster clearance, and fewer disputes.

If you’re unsure which documents your shipment requires, contact our team—we’ll review your product type, destination, and Incoterms, and prepare every document on your behalf to ensure smooth delivery from China to your door.