Many people think importing from China to the USA requires a registered business or import license. In reality, it doesn’t. Over my 12+ years at DFH Logistics, I’ve helped thousands of individual buyers, small online sellers, and startup founders successfully import goods from China without a business license — all legally and smoothly.

You can legally import from China to the USA without a business license by acting as an individual importer and using a professional freight forwarder that offers DDP (Delivered Duty Paid) shipping. This all-inclusive shipping solution handles customs clearance, duty payment, and delivery right to your doorstep — so you don’t need to deal with complex paperwork or U.S. Customs yourself.

Can You Really Import from China to the USA Without a Business License?

Yes, absolutely. U.S. Customs and Border Protection (CBP) allows individuals to import goods for both personal and commercial use without a business license — as long as your shipment complies with U.S. regulations and taxes are properly paid.

If your shipment’s declared value is below $800, it qualifies for Section 321, which means it enters duty-free and doesn’t require a customs entry. This is ideal for e-commerce sellers testing new products or individuals buying in small quantities. For goods above $800, you’ll need a customs declaration — which DFH Logistics can handle for you through our DDP service.

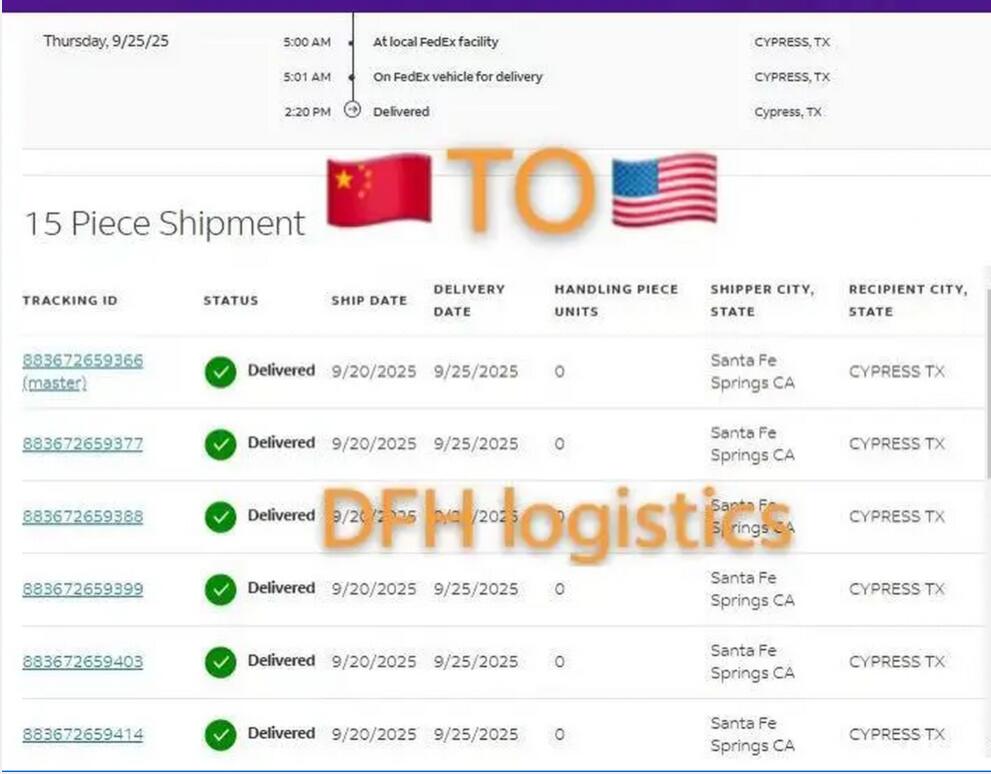

For example, one of my clients, Alex from Texas, started importing small electronics from China worth $500 per shipment. Using our DDP air freight service, he received goods directly at his doorstep within 10 days, with all taxes prepaid. No customs calls, no business paperwork — just simple, compliant delivery.

What Documents and Information Do You Need as an Individual Importer?

Even without a business license, U.S. Customs still requires basic importer identification and documentation. Here’s what you’ll need:

- Your Full Name and U.S. Address — for delivery and customs purposes.

- Personal ID or Passport Copy — used by your freight forwarder for customs entry.

- Commercial Invoice — issued by your Chinese supplier, listing product details, quantity, and value.

- Accurate HS Code — used to classify your product for duty calculation.

- Product Compliance Certificates (if applicable) — especially for electronics, toys, or cosmetics.

When you use DFH Logistics, we take care of document preparation, double-check your product category, and handle compliance requirements. You simply provide supplier details and your delivery address — and we manage the rest.

How Does DDP Shipping Help You Import Without a License?

If you don’t have a business license, the DDP (Delivered Duty Paid) solution is your best and safest option. It’s specifically designed for importers who want door-to-door delivery without handling customs clearance or duty payment themselves.

Here’s what DDP includes:

- Pickup from your Chinese supplier (even from multiple suppliers)

- Export declaration in China

- Air or sea transport to the USA

- Import customs clearance under DFH’s name

- Duty and tax prepayment

- Final delivery to your door or warehouse

You don’t need to register as an importer or deal with the U.S. Customs system. DFH acts as the importer of record, ensuring your goods pass customs legally and efficiently.

For example, Emma from California, a homeowner furnishing her new house, wanted to import home furniture directly from several suppliers in Foshan, China. She used our DDP sea freight channel to simplify the process. We picked up her furniture from each supplier, consolidated everything in our Shenzhen warehouse, professionally repacked the items for protection, handled export declaration, cleared U.S. customs, paid all import duties, and delivered the furniture safely to her home in Los Angeles.

The entire process took 30 days door-to-door — no hidden charges, no customs paperwork, and no damage during transport.

What Are the Best DDP Shipping Options for Individuals?

We offer multiple DDP shipping methods from China to the USA, depending on your cargo size, timeline, and budget:

| Shipping Method | Transit Time | Ideal Shipment | Key Advantages |

|---|---|---|---|

| DDP Express (DHL/UPS/FedEx) | 3–7 days | Samples, small parcels | Fastest, easy tracking, minimal paperwork. |

| DDP Air Freight | 7–12 days | Medium shipments under 500 kg | Reliable door-to-door delivery with all duties prepaid. |

| DDP Sea Freight | 25–35 days | Large or heavy cargo | Most cost-effective, ideal for bulk orders. |

| DDP Sea + Express Combined | 18–25 days | Urgent but large shipments | Balance of cost and speed. |

Each DDP route is fully door-to-door — meaning you don’t need a customs broker or business account. DFH handles every step under our own importer record.

Case Example:

Akelia from Florida, an individual Amazon seller, ships small batches of phone cases every month using our DDP air freight. We collect goods from three different suppliers, consolidate them, handle the customs declaration under DFH, and deliver to his Amazon FBA warehouse in Miami — all without him needing a business license or importer number.

What Import Taxes Apply If You Don’t Have a Company?

Taxes depend on your product type and declared value, not whether you have a company. When shipping under DDP, DFH pays these taxes on your behalf in advance.

Typical charges include:

- Import duties — based on HS code and product category

- Customs clearance fee — included in DDP price

- Sales tax — only applicable if you sell domestically in the U.S.

For individual buyers, DDP shipping simplifies everything — your quote already includes these costs, so you never face surprise customs bills.

Example:

Linda from New York imported $1,200 worth of handbags using our DDP sea line. We paid her import duty and customs tax upfront. When her shipment arrived, the courier simply delivered the packages to her home. She didn’t even receive a customs notification — everything was handled seamlessly.

How to Avoid Customs Problems When Importing as an Individual?

If you’re not a business, customs issues can still occur due to incorrect documentation or undervalued goods. Here’s how to avoid them:

- Always declare your goods truthfully.

- Avoid restricted or branded imitation products.

- Use correct HS codes — we help verify these before shipment.

- Prepare supplier invoices — customs may ask for proof of purchase.

- Use DDP shipping to stay compliant — since your forwarder handles customs under their own importer record.

At DFH Logistics, we’ve built a reputation for smooth customs clearance. Our U.S. agents are experienced in managing DDP shipments, ensuring zero delays or clearance failures.

Read More about all the details of: How to Avoid Customs Delays When Shipping from China

Can You Resell Imported Goods Without a Business License?

Yes, you can legally resell imported goods even as an individual. Many of our clients start this way — testing product demand before formally registering a business.

Platforms like eBay, Etsy, and Facebook Marketplace allow you to sell as an individual. You can start small, using DDP shipping to receive inventory directly at your home or storage unit. Once your sales grow, registering a business becomes a natural next step.

Example:

Sarah from Illinois began importing fashion accessories worth $600 per shipment. She used DFH’s DDP air freight service, which delivered each batch to her home without customs involvement. Today, after seeing consistent profits, she has registered an LLC — but she continues to use our DDP line for all imports.

How DFH Logistics Helps Individual Importers Succeed

At DFH Logistics, we understand that not every importer is a large company. Many of our clients are individuals or small online sellers just starting out. That’s why we’ve designed specialized DDP shipping solutions to remove the barriers for non-licensed importers.

Our DDP service covers everything:

- Pickup from suppliers in any Chinese city

- Free consolidation and 30 days of warehouse storage

- Professional repacking and labeling (for Amazon or e-commerce)

- Export declaration in China

- Customs clearance in the USA

- Import tax and duty prepayment

- Final delivery to your home, warehouse, or FBA center

With DFH, you don’t need to register a company, apply for an import license, or communicate with customs. We’ve helped thousands of individuals import electronics, tools, fashion accessories, and household goods safely, legally, and affordably.

If you want to start importing from China today — even without a business license — our DDP shipping solution is your best choice.

Conclusion

Importing from China to the USA without a business license is not only legal but practical with the right logistics partner. DDP shipping eliminates all the technical barriers — customs clearance, duties, import licenses — so individuals can focus on buying, selling, and growing their business.

Contact DFH Logistics for a free DDP quote

Related Reading: