Declaring customs value correctly is one of the most important — yet often misunderstood — parts of importing from China.

Many importers get caught between trying to save on duties and staying compliant, only to face customs delays, inspections, or unexpected tax adjustments.

After over 12 years at DFH Logistics, managing thousands of shipments across the USA, Europe, and Australia, I’ve seen every kind of mistake — from undervalued invoices that led to penalties to shipments stuck at port for weeks because “declared value” didn’t match supporting documents.

This guide gives you a clear, real-world explanation of how to declare customs value properly — step by step — so you can import confidently and avoid costly surprises.

Why Customs Value Declaration Matters

Your customs declaration isn’t just a number — it defines how much tax you pay, how long your goods stay in customs, and whether your business record stays clean.

When customs sees your shipment, they first verify whether your declared value aligns with the market average for similar goods under your HS code.

If the declared value is too low, customs assumes you’re under-declaring to avoid tax — leading to red flags, manual inspections, or even fines.

If the value is too high, you end up overpaying duty and VAT unnecessarily.

For example, in one DFH client case, a European importer under-declared electronic accessories by 30% to save on VAT. Customs reviewed the market data, increased the value, imposed a €2,400 fine, and delayed the shipment by 21 days. From that point, he let us handle all future declarations — and never had an issue again.

What Is Customs Value?

The customs value is the price that customs authorities use to calculate import duties, VAT, and other charges on your shipment.

It usually represents the total transaction value of the goods sold for export, adjusted by the applicable Incoterms (FOB, CIF, DDP, etc.).

Here’s how customs value differs depending on your shipping term:

| Incoterm | What It Includes | Example of Declaration |

|---|---|---|

| EXW (Ex-Works) | Factory price only | Buyer arranges all transport and export. |

| FOB (Free on Board) | Product + local export cost | Most common for bulk shipments. |

| CIF (Cost, Insurance & Freight) | Product + freight + insurance | Common for sea freight imports. |

| DDP (Delivered Duty Paid) | Product + freight + insurance + duties/taxes | All-inclusive, handled by forwarder. |

Understanding these terms ensures your documents (invoice, bill of lading, insurance) are consistent — the foundation of a correct declaration. You can also refer to our detailed explanation of DDP Shipping from China to better understand how Incoterms affect customs value calculation.

How to Calculate Customs Value Step-by-Step

You can calculate customs value in three simple steps — but precision is key.

Start with the commercial invoice price.

This must reflect the actual amount paid or payable to your Chinese supplier.Add international shipping and insurance costs (for CIF or DDP terms).

Customs needs to know how much was spent bringing the goods to the border.Exclude post-import costs such as local warehousing, domestic delivery, or marketing.

Example (CIF Basis):

| Item | Description | Amount (USD) |

|---|---|---|

| Product cost | 1,000 Bluetooth speakers | $10,000 |

| Freight | Sea freight from Shenzhen to Los Angeles | $1,200 |

| Insurance | Cargo coverage | $50 |

| Total Customs Value (CIF) | $11,250 |

If your invoice only shows FOB terms, you’ll need to provide separate freight and insurance cost proof to satisfy customs. Learn more about calculating accurate freight costs in our article How to Reduce Shipping Costs: 13 Useful Tips.

What Documents Are Required for Customs Value Declaration?

Accurate documentation is your only protection against customs disputes.

Every figure on your invoice must match the details on your other paperwork.

Essential documents include:

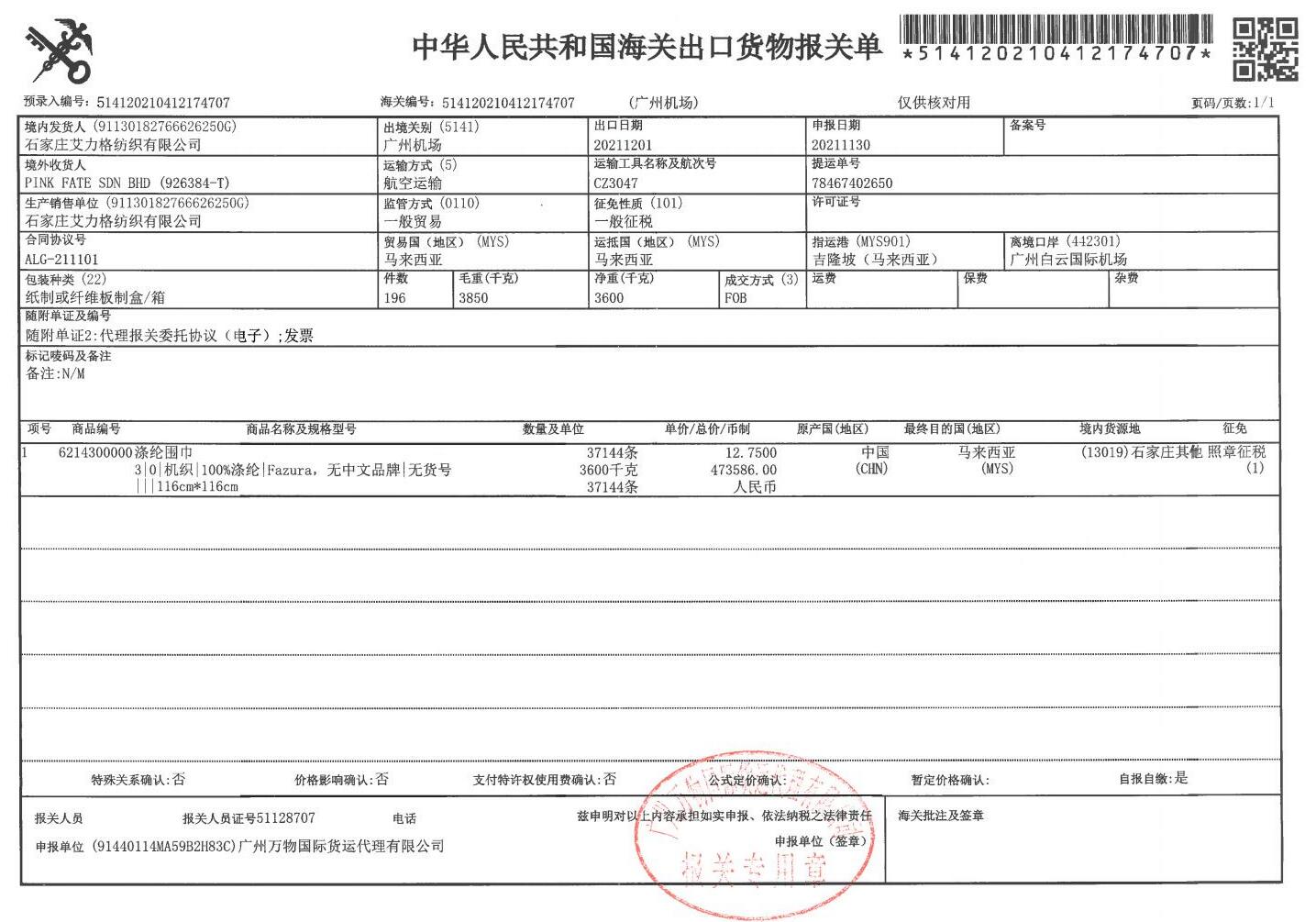

- Commercial Invoice: Must show product name, unit price, total value, HS code, and Incoterm.

- Packing List: Confirms the quantity, dimensions, and gross/net weight.

- Bill of Lading / Air Waybill: Proof of shipment route and transport cost.

- Insurance Certificate: (if applicable) validates declared CIF cost.

- Payment Record / Bank Slip: Often requested when customs doubts the declared value.

- Purchase Contract or Proforma Invoice: Supports the authenticity of transaction value.

At DFH Logistics, we verify these documents before shipment, ensuring each one aligns perfectly. This pre-check alone can reduce 80% of potential customs issues. To prepare these properly, you can also review Common Shipping Challenges When Importing from China and How to Solve Them.

Common Mistakes Importers Make

The most frequent errors come from trying to “save tax” through undervaluation or poor documentation.

Here are the real-world pitfalls I’ve seen repeatedly:

- Declaring a much lower invoice value — customs compares it to database averages and rejects it.

- Invoice currency mismatch — e.g., supplier issues invoice in RMB, but customs expects USD/EUR.

- Declaring FOB when shipping under CIF or DDP.

- Forgetting to include insurance or freight in CIF declarations.

- Using one invoice for multiple shipments — a red flag for customs audits.

These mistakes cost time, money, and credibility. Once flagged, your company’s future shipments may face stricter inspections.

How Customs Authorities Verify Declared Value

Customs doesn’t simply “trust” your declared value — they verify it using international valuation databases.

They cross-check your data with:

- Historical import records of the same HS code and origin country.

- Supplier’s export database (for Chinese exports).

- Market references, such as Alibaba pricing or industry averages.

If customs finds the declared value unrealistic, they’ll apply the WTO Valuation Agreement methods to adjust it — possibly increasing your dutiable value.

This process can delay release by several days or even weeks.

At DFH, we handle this proactively: before shipment, our compliance team ensures your invoice value aligns with standard customs expectations in your destination country.

How to Avoid Customs Valuation Problems

Transparency and consistency are the key to a clean customs record.

Here’s how to prevent issues:

- Be truthful — always declare the actual transaction value.

- Keep document consistency — invoice, packing list, and payment must match.

- Understand your Incoterm — don’t declare FOB when you’re shipping DDP.

- Prepare for inspection — keep photos, purchase records, and proof of payment ready.

- Work with experienced forwarders — DFH Logistics helps you prepare customs-compliant paperwork and proactively reviews values before declaration.

When customs officers see consistent and professional documentation, they rarely question the value. That’s why our clients’ DDP shipments consistently clear faster than market average.

Real Example: DFH Solved a $4,000 Customs Value Dispute

One of our clients in the U.S. imported home lighting fixtures worth $28,000 (CIF).

The local customs system flagged it because average imports of similar goods were valued at $40,000.

Instead of waiting weeks for an appeal, our customs team prepared:

- The supplier’s full export contract

- The bank transfer proof

- The original Alibaba order record

- Photos and packing details proving model difference

Within 48 hours, customs approved the original value — avoiding revaluation and saving $4,000 in unnecessary duty.

That’s the difference a professional forwarder makes.

How DFH Logistics Helps with Customs Declaration

With 12+ years of experience, DFH Logistics provides complete customs declaration support for importers worldwide.

Our services include:

- Preparing commercial invoices and packing lists according to customs standards

- HS code classification and pre-clearance value verification

- Customs communication and document defense during inspections

- DDP shipping (duties & taxes prepaid) for seamless clearance

- Customs value audits to prevent future penalties

We don’t just move cargo — we ensure your paperwork tells the right story, minimizing the chance of any customs delays.

Conclusion

Declaring customs value correctly is not about guessing a number — it’s about building trust with customs and protecting your business from risk.

Once you understand how customs determines value and prepare documentation accordingly, your shipments will move faster and with fewer surprises.

If you’re still unsure how to declare properly for your next import, Contact our DFH Logistics Team.to help.

Our team handles end-to-end logistics — from pickup in China to customs clearance and delivery — ensuring every document, value, and code aligns perfectly.