Many importers lose thousands of dollars every year not because of product quality or logistics delays, but due to unexpected import penalties. These penalties often arise from inaccurate declarations, missing paperwork, or violations of U.S. Customs and Border Protection (CBP) regulations. In this article, I’ll share the most common penalties when importing from China to the USA—and how you can avoid them completely.

After more than 12 years managing thousands of U.S.-bound shipments at DFH Logistics, I’ve seen every kind of customs mistake—from undervalued invoices to missing FDA documents. Most of these cases could have been avoided with proper guidance and preparation. This guide will help you stay compliant, save money, and build a smooth long-term import operation.

1. Misdeclaring Customs Value

Declaring an incorrect customs value—whether too low or too high—is one of the most common and costly mistakes.

Many importers ask their suppliers to “declare a lower value” to save on duties. But U.S. Customs (CBP) actively checks valuation consistency through data from shipping lines, supplier records, and historical entries. If your declared value doesn’t match, you risk severe penalties or seizure.

How to avoid it:

- Always declare the true transaction value (invoice price paid to the supplier).

- Include freight, insurance, and other costs if your Incoterm requires it (e.g., CIF).

- Keep all payment proofs (bank transfers, Alibaba payments, etc.) in case CBP requests them.

- Understand how customs value works by reading this detailed guide: How to Declare Customs Value When Importing from China.

2. Using the Wrong HS Code

Incorrect classification under the Harmonized System (HS) can trigger underpaid duties, retroactive fines, or even import bans.

Each product has a specific HS code determining the duty rate, admissibility, and required documents. Misclassification—intentional or accidental—can result in penalties of up to two times the lost revenue and a record of noncompliance.

How to avoid it:

- Verify your HS code through the official CBP database or consult a licensed customs broker.

- Confirm the HS code used by your supplier aligns with your product’s material and function.

- Stay updated on tariff changes under Section 301 or other U.S.-China trade measures.

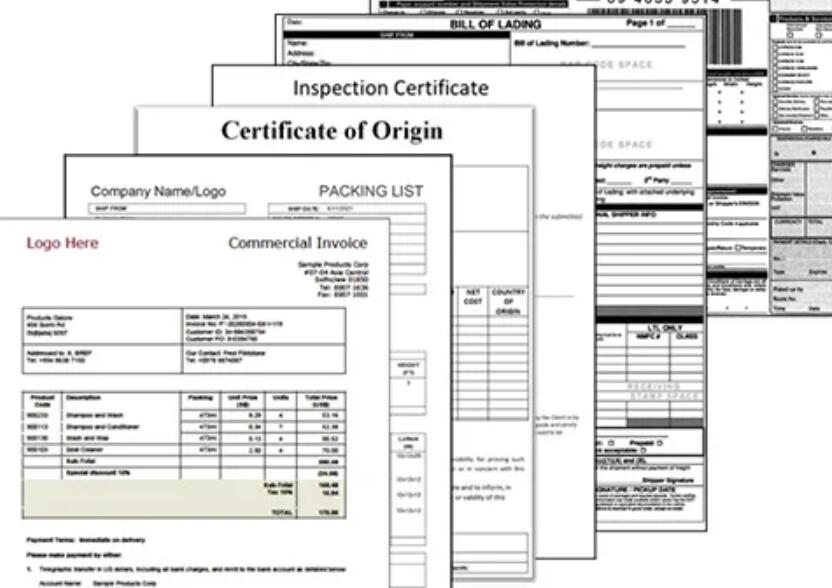

3. Missing or Incorrect Import Documents

Incomplete or inconsistent paperwork can lead to shipment holds, inspections, or rejections by CBP.

Common missing documents include:

- Commercial invoice (incorrect value or missing Incoterms)

- Packing list (inconsistent quantities or weights)

- Arrival notice

- Importer security filing (ISF)

- Certificates (FDA, FCC, CPSC, EPA, or USDA depending on product type)

How to avoid it:

- Double-check that all documents match exactly (invoice, packing list, and shipping label).

- Submit the Importer Security Filing (ISF) 24 hours before vessel departure for sea shipments.

- For sensitive products (electronics, food, cosmetics, medical), verify additional U.S. agency requirements before shipment.

- DFH Logistics can help prepare and check your full document package before shipping.

4. Failing to File ISF (Importer Security Filing) on Time

Late or missing ISF filings can result in penalties up to $5,000 per violation.

CBP requires ISF data for all ocean shipments entering the U.S. It must be filed 24 hours before the vessel leaves the port of origin in China. Many importers rely on suppliers or forwarders who forget or delay this submission.

How to avoid it:

- Always confirm your freight forwarder has filed the ISF before vessel departure.

- Ensure all key information—supplier name, buyer, HTS code, container stuffing location—is correct.

- Keep a confirmation record from your forwarder.

- Learn more about how DFH handles full DDP sea shipping (including ISF filing) here: Sea Freight Service.

5. Failing to Comply with Product Regulations

Importing non-compliant products—especially electronics, cosmetics, food, or toys—can trigger FDA, FCC, or CPSC penalties and even product destruction.

For instance:

- Electronics need FCC certification

- Cosmetics require FDA registration

- Children’s products need CPC and tracking labels

- Chemical products may require EPA approval

How to avoid it:

- Check which U.S. agency regulates your product before shipping.

- Ask suppliers to provide valid test reports and certificates.

- If unsure, DFH can help verify your product’s compliance requirements before export.

6. Violating Anti-Dumping or Section 301 Tariffs

Importers unaware of additional U.S. tariffs (like Section 301 on China) can face retroactive duty bills, audits, and penalties.

If your product falls under Section 301 or anti-dumping lists, failing to declare correctly could lead to double duties or seizure.

How to avoid it:

- Check CBP’s official Section 301 and anti-dumping list regularly.

- If you import high-risk items (e.g., aluminum, steel, solar panels, furniture), consult your forwarder or broker first.

- Always reflect these additional tariffs in your landed cost calculations.

7. Falsifying Country of Origin

Mislabeling goods to avoid “Made in China” tariffs is a serious customs offense.

CBP conducts random checks and uses import data to verify country of origin. Misrepresentation may result in fines, product seizure, and even criminal investigation.

How to avoid it:

- Ensure product labeling matches actual manufacturing origin.

- Avoid transshipment schemes through third countries to evade tariffs.

- Include clear “Made in China” marking on both packaging and product.

8. How DFH Logistics Helps Importers Avoid Penalties

At DFH Logistics, we don’t just move goods—we help you stay fully compliant.

Our 12+ years of U.S. import experience allow us to manage the full door-to-door process safely:

- Prepare accurate customs documents

- File ISF and handle DDP customs clearance

- Check HS codes and product certificates

- Offer customs insurance and compliance consulting

We ensure your shipment clears smoothly without unexpected penalties or demurrage charges.

If you’re unsure how to handle your next shipment, our experts can review your documents before export to catch issues early.

Conclusion

Import penalties are often the result of small oversights—but their cost can be huge.

By understanding these common mistakes and partnering with an experienced logistics provider like DFH, you can avoid fines, delays, and compliance headaches.

The safest way to import from China to the USA is with proper documentation, accurate declarations, and reliable customs handling from start to finish.